Most people don’t think of Canada as a top fintech destination. That’s because the country doesn’t advertise itself loudly. But behind the scenes, it has everything a modern fintech needs to launch, grow, and stay compliant.

Canada now supports roughly 1,500 fintech companies, spanning payments, crypto, lending, wealth management, insurtech, and RegTech. The 2024 total investment reached a record US $9.5 billion across 121 deals, far exceeding the US $1.1 billion investment in 2022. Nuvei’s US $6.3 billion acquisition and Plusgrade’s US $1 billion private equity investment accounted for nearly two-thirds. Outside these deals fintech venture rounds still rose to US $1.09 billion across 90 deals in 2024.

These numbers highlight Canada’s growing position as a major fintech market, even if it doesn’t always capture global headlines.

One Federal Regime Provides National Reach

Canada requires only one federal MSB registration via FINTRAC to operate nationwide. No need to register in every province. This clears the way for businesses in payments, wallets, foreign exchange, or crypto to launch quickly and cost-effectively.

It also helps that Canada was among the first G7 countries to classify crypto exchanges as MSBs, oofffering legal clarity from 2020.

Responsive Regulators and Supportive Infrastructure

The RC system is straightforward. Once registered, you manage risk, appoint a CAMLO, monitor transactions, and submit reports. Regulators expect professionalism but remain open to dialogue. Sandbox programs, updated guidelines, and support for RegTech make compliance less of a hurdle and more of a collaboration.

Why International Startups Prefer Canada

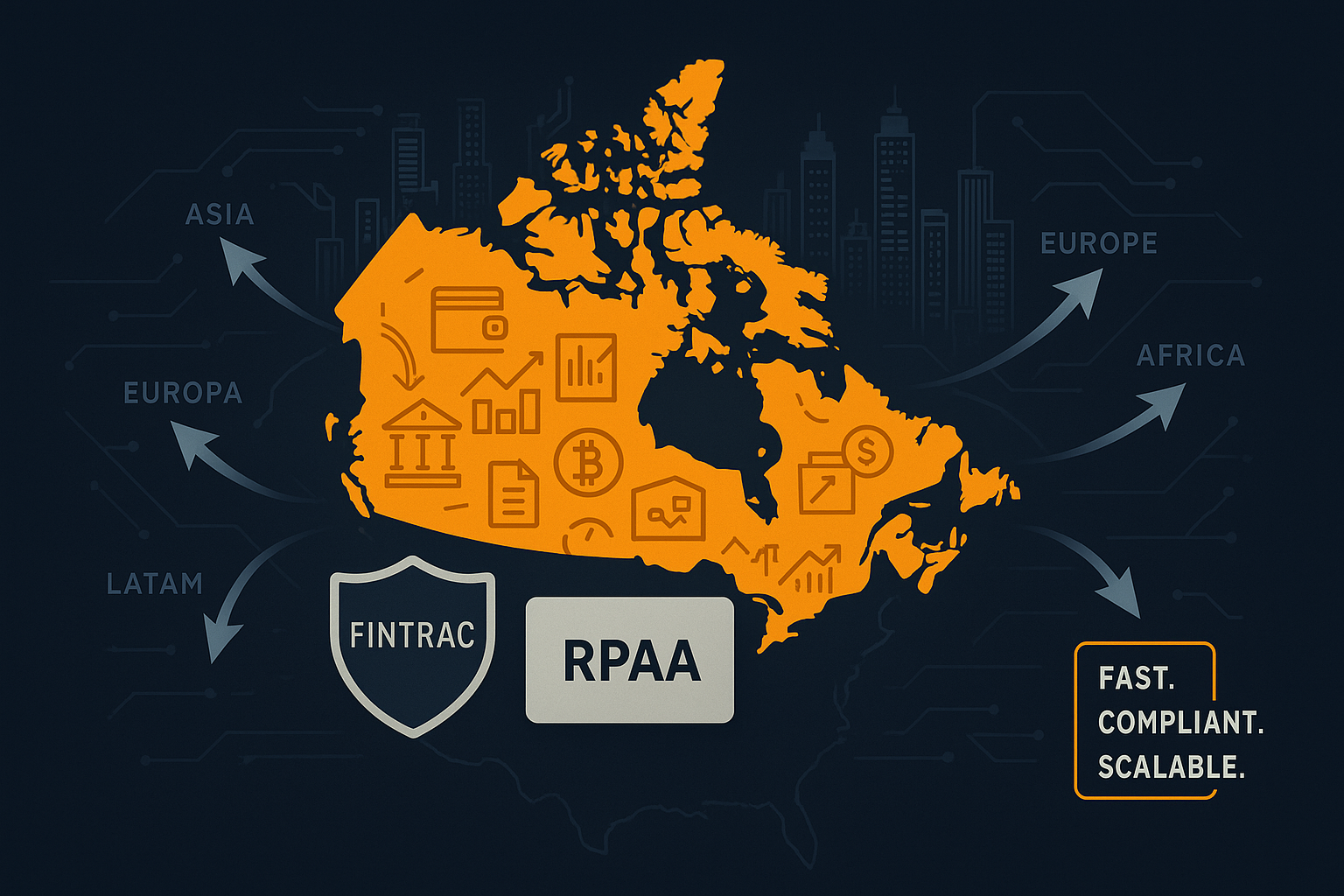

Founders from Europe, Asia, Africa, and LATAM now see Canada as an perfect launchpad for regulated business.

Canada offers:

-

Legal certainty and transparent law

-

One-stop federal AML registration (Mostly)

-

Access to G7 banks and stable infrastructure

-

Fast registration for foreign MSBs

-

R&D tax credits and startup grants

-

A multilingual and diverse testing ground

-

Talent trained in both compliance and fintech

RPAA Offers Parallel Path for Payment Firms

If your business deals in payment processing, stored value, or wallets, you may also register under the Retail Payment Activities Act (RPAA). This adds Bank of Canada oversight but also structured risk frameworks.

AML Incubator supports both FINTRAC and RPAA registration to build full compliance efficiently.

Canadian Regulators See Innovation as Strength

Regulators in Canada, federal and provincial, usually emphasize compliance outcomes over bureaucratic obstacle. FINTRAC responds to queries. Provincial securities regulators offer sandboxes. Guidance is focused on outcomes rather than harsh control.

Innovation Backed by Policy

Canada supports startup growth through:

-

SR&ED tax credits and R&D grants

-

Visa and immigration paths for founders and tech talent

-

Government-backed fintech initiatives and partnerships

-

High digital inclusion, nearly 98% of Canadians have access to financial services

-

Strong AI and regulatory technology adoption ahead of global averages

AML Incubator Helps You Enter Canada Fast

Our services include:

-

Token due diligence and crypto compliance support

Through AMLI Labs we offer compliance-first support-for-equity options for qualified fintechs.

Final Thoughts

Canada may not make headlines like Silicon Valley or London. But fintech founders looking for fast, clear, and compliant paths should look north.

Regulators are approachable. Laws are clear. Costs are reasonable. If you’re planning your next launch, Canada deserves serious consideration.

AML Incubator is your trusted partner in regulatory excellence. Reach out to plan your launch with full compliance and minimal friction.