FINTRAC registration is required across Canada, but some provinces—like Quebec—impose additional licensing rules. Learn where your MSB needs to go beyond federal compliance.

In Canada, all money services businesses need to register with FINTRAC. That applies whether you're based here or abroad. It’s the main step for starting up legally.

But depending on where your business operates, other rules might still apply. Quebec is the biggest example. Some provinces also add local business rules that can impact your setup.

What FINTRAC Requires

Once you're registered with FINTRAC, you need a working AML compliance program. That includes naming a compliance officer, setting up policies, verifying clients, reporting suspicious activity, and keeping proper records.

Registration is just the beginning. You’ll need to update your AML program over time, stay on top of new risks, and report major changes to FINTRAC. Businesses that ignore this often run into problems later.

For more on what this involves, read How to Hire a CAMLO in Canada.

Quebec Is the Exception

Quebec has its own registration process through Revenu Québec. If you plan to serve clients there, you need to complete both the federal and provincial steps.

The province asks for background checks, full compliance documents, and yearly renewals. There’s also a fee for the application. Revenu Québec handles the review process, and the AMF enforces it.

Even if you're already registered federally, Quebec can still fine or restrict you if you skip this step. Some companies decide not to operate in Quebec because of the added cost and oversight.

If you're unsure whether to include Quebec in your launch, AML Incubator's effectiveness review can help you assess the risk.

What About the Rest of Canada

Other provinces don’t ask for a second MSB registration. You still need to register your business locally and meet tax obligations, but you won’t need separate approval to operate as an MSB.

Even so, there are a few things to watch.

If you’re federally incorporated and want to do business in multiple provinces, you’ll need to register as an extra-provincial corporation in each one. Local tax rules, business naming laws, and zoning issues for physical branches also apply.

British Columbia has talked about creating its own MSB registration, but it hasn’t happened yet. It may still go ahead, especially with new financial crime initiatives in the province. To stay updated, check AML Incubator’s blog for changes.

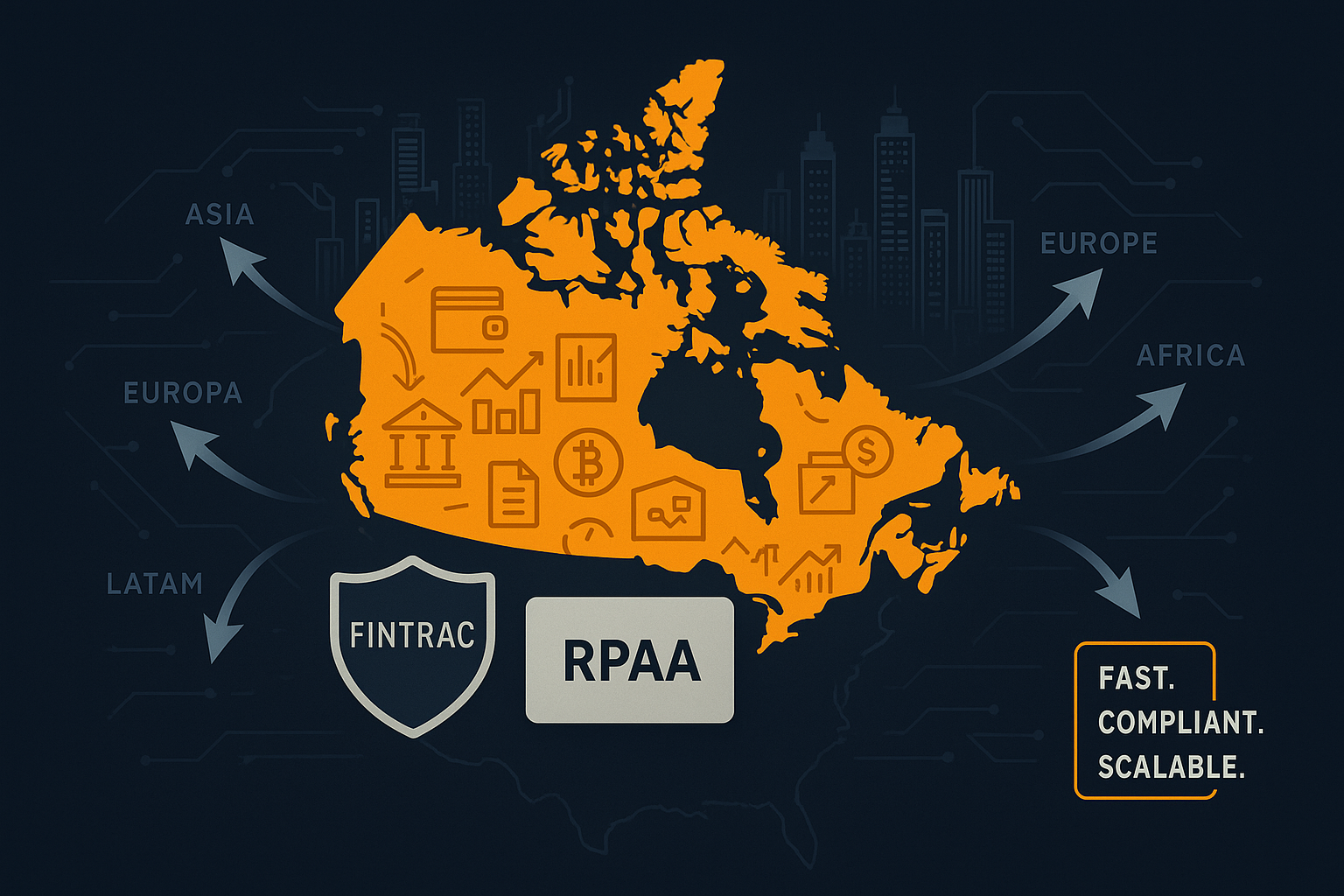

Some MSBs May Fall Under RPAA Too

If your business handles digital wallets, stored value, or payment processing, you might also fall under the Retail Payment Activities Act. This is a separate federal framework managed by the Bank of Canada.

If the RPAA applies to you, you’ll need to register again as a payment service provider and build a risk and incident response program. AML Incubator offers full RPAA support if you need help understanding or managing this.

Foreign MSBs Need to Plan Carefully

Canada’s system looks simple. You register once and you're set. But foreign companies often get caught off guard by the details.

If you plan to serve clients across Canada, you may need to deal with Quebec’s rules, local tax offices, and dual frameworks like the RPAA.

For example, a UK-based crypto exchange or a US remittance firm can register as a foreign MSB and serve Canadian users. But they still need to meet FINTRAC’s full compliance requirements, appoint a CAMLO, and stay on top of changing rules. Quebec registration may apply too.

To understand why Canada remains a smart move despite these challenges, read Why Foreign MSBs Are Flocking to Canada.

What AML Incubator Can Do

We help Canadian and international MSBs meet compliance needs across all provinces.

That includes:

-

Filing with Revenu Québec

-

Extra-provincial registration

-

Appointing a CAMLO or MLRO

-

Drafting AML policies and procedures

-

Filing STRs, LCTRs, EFTRs, and LVCTRs

-

Supporting you during FINTRAC audits

-

Preparing your team for annual reviews

-

Helping with ownership changes, product launches, or risk changes

We also help PSPs register under the RPAA and build the required compliance infrastructure.

We don’t just register companies. We help you maintain long-term compliance so your MSB can scale without delay.

Final Notes

So does your province matter? Yes. FINTRAC handles the core registration. But Quebec adds another layer. Other provinces still require local filings, tax registrations, and proper business setup. And if you're a PSP, the RPAA may apply too.

Every province has different timelines, fees, and business requirements. Ignoring those slows down launches and adds risk.

AML Incubator is your trusted partner in regulatory excellence. If you’re launching or expanding across Canada, we can help you stay compliant every step of the way.