A crypto exchange allows people to buy, sell, or trade digital assets like Bitcoin, Ethereum, or stablecoins. Some offer direct purchases, while others match buyers and sellers or act as custodians.

Globally, regulators use the term Virtual Asset Service Provider, or VASP, to describe these businesses. A VASP may include exchanges, wallet providers, OTC desks, and certain DeFi platforms. The term comes from the Financial Action Task Force (FATF), which sets the global AML standards most countries follow.

If your business involves crypto transfers, wallet services, or trading platforms, chances are you're a VASP under local law.

Where Are VASPs Regulated?

Almost every major jurisdiction has adopted or is implementing AML laws for crypto companies. The rules vary, but the core obligations are similar.

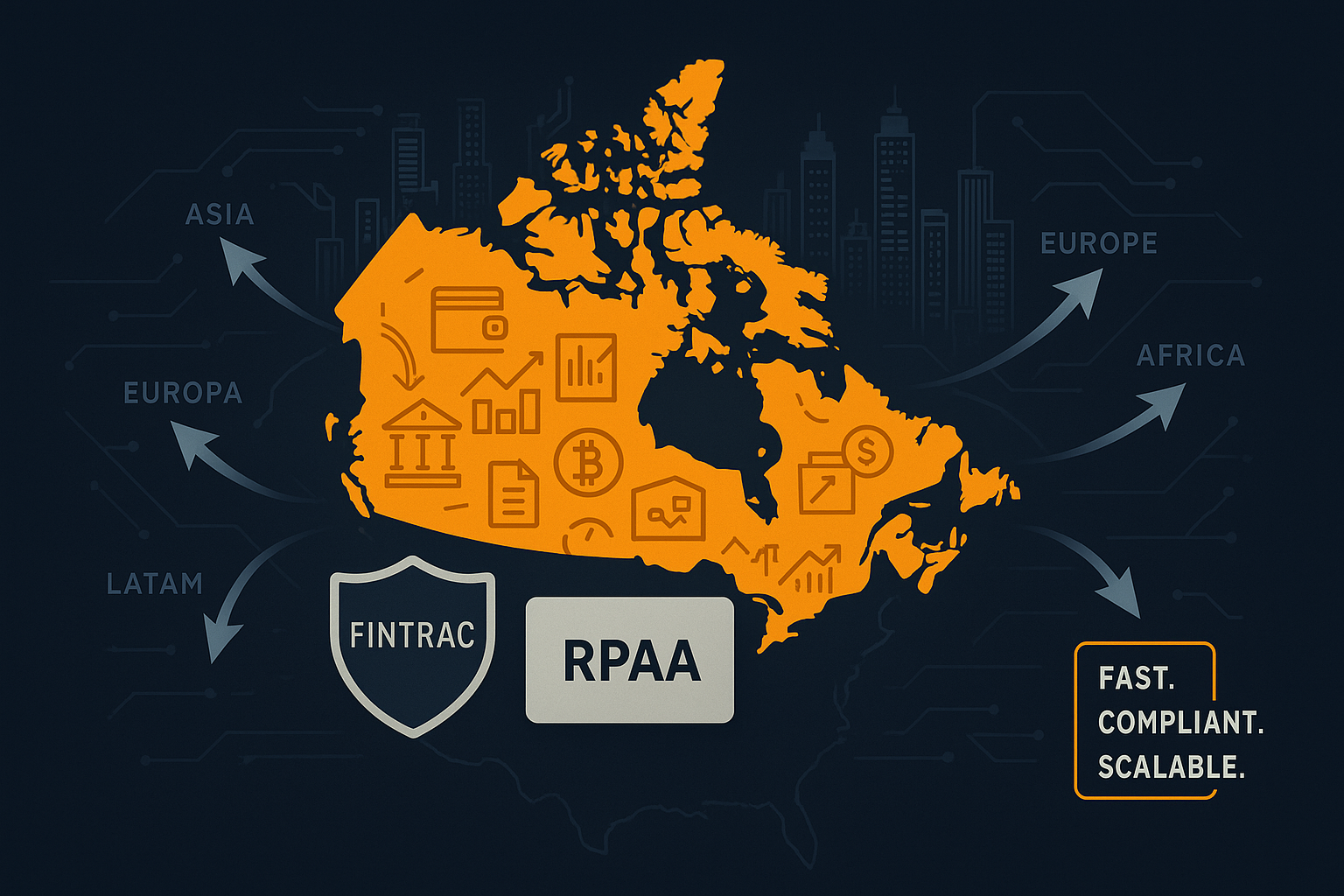

Canada

In Canada, VASPs must register as Money Services Businesses (MSBs) with FINTRAC. This applies to any company offering crypto exchange, transfer, or custodial services.

Key requirements:

-

MSB registration

-

Appointed Cheif Anti-Money Laundering Officer (CAMLO)

-

AML/CTF compliance program

-

KYC and transaction monitoring

-

Reporting large crypto transactions

-

Recordkeeping and audit readiness

In some cases, businesses also fall under the Retail Payment Activities Act (RPAA) and must register with the Bank of Canada. Learn more on our pages for MSB Registration, RPAA Registration, and CAMLO Services.

European Union

The EU defines VASPs under its AML directives and the upcoming MiCA (Markets in Crypto-Assets Regulation). Under MiCA, crypto service providers must register and meet new consumer protection and risk management rules.

MiCA applies across all EU states and includes:

-

Licensing under a national authority

-

AML program requirements

-

Custody controls

-

Whitepaper obligations for token issuers

-

Cross-border passporting within the EU

United Arab Emirates (UAE)

In the UAE, VASPs are regulated at both the federal level and by free zones like VARA (Virtual Assets Regulatory Authority) in Dubai.

Key features:

-

Pre-approval and licensing required

-

AML framework aligned with FATF

-

Clear rules for token issuance, custody, and exchange

-

Inspections and financial reporting duties

Our team supports UAE-based startups working with VARA and ADGM, including token compliance and internal audits.

Singapore

Singapore’s MAS (Monetary Authority of Singapore) regulates VASPs under the Payment Services Act. A crypto company must be licensed for digital payment token services if it facilitates trading or transfers.

The process involves:

-

Registration and licensing

-

AML policies and transaction monitoring

-

Risk-based due diligence

-

Fit and proper management standards

United States

The US treats VASPs as money transmitters, with registration required under FinCEN at the federal level. State-level licensing is also required in most jurisdictions, making compliance complex.

Obligations include:

-

FinCEN registration

-

AML policy and suspicious activity reporting

-

State-by-state money transmission licenses

-

Enhanced enforcement risk for violations

The US remains one of the most fragmented and high-risk jurisdictions from a compliance standpoint.

Shared Compliance Requirements Across Jurisdictions

Despite regional differences, most VASPs must do the following:

-

Register or license with a financial regulator

-

Maintain a written AML/CTF program

-

Appoint a qualified compliance officer

-

Identify and verify customers (KYC)

-

Screen for sanctions and politically exposed persons (PEPs)

-

Monitor and report suspicious transactions

-

Keep audit-ready records

These requirements apply whether you're launching in Canada, expanding into Europe, or entering the UAE market. You can explore common pitfalls in our post on navigating compliance challenges in FinTech.

How AML Incubator Supports VASPs Globally

We’ve worked with crypto exchanges and service providers across Canada, the EU, Dubai, Singapore, and the US. Our services include:

-

Registration with FINTRAC, RPAA, and other regulators

-

Ongoing CAMLO or MLRO support

-

Transaction monitoring system setup

-

Risk-based KYC workflows

-

Effectiveness reviews and audit prep

-

Regulatory remediation after warnings or fines

-

Custom compliance frameworks for VASP-specific business models

Final Thought

VASPs are no longer flying under the radar. Whether you're in Canada, Dubai, Europe, or Singapore, regulators expect more than surface-level policies.

You need systems that match your services. You need documentation that proves what you’ve built. And you need people who understand crypto, regulation, and what happens when the two don’t align.

Explore our services for Crypto Exchanges and VASPs or contact us to make sure your setup is compliant and ready to grow.