MSB Registration in Canada: Why It Matters and What FINTRAC Looks For

Registering as a Money Services Business (MSB) in Canada is required under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA). Beyond legal compliance, registration directly affects market access, credibility, and operational stability.

Canada’s MSB regulator, FINTRAC, has steadily increased expectations for decision-making authority and oversight, operational transparency, and how AML controls function in practice. Companies can plan ahead rather than respond to pressure by being aware of what registration entails and how FINTRAC actually inspects businesses. MSB registration is particularly important as regulatory scrutiny and enforcement expectations rise.

Legal Requirements and Regulatory Obligations

MSB registration places a business under FINTRAC’s supervisory scope. Registration confirms that the business:

-

Operates under the PCMLTFA and its associated regulations, including:

-

Large cash transaction reporting (Section 7)

-

Suspicious transaction reporting (Section 7.1)

-

Recordkeeping obligations (Sections 9–10)

-

Maintains a risk-based compliance structure aligned with its business activities.

-

Has controls, governance, and risk management practices that are operationally credible, not just documented on paper.

Registration signals to banks, partners, and clients that operations are transparent, compliant, and functioning as intended. Even after registration, MSBs remain accountable for meeting PCMLTFA obligations. This includes conducting periodic risk assessments, keeping reporting and records current, and ensuring AML controls reflect actual operations. A Compliance Officer with defined authority helps signal operational maturity to regulators and banking partners.

Importantly, FINTRAC registration is not a formal “license” but establishes reporting entity status under the law.

Which Businesses Must Register as an MSB in Canada

A business must register as an MSB if it engages in any of the following:

-

Foreign exchange services

-

Money remittance or transmission

-

Issuing or redeeming money orders, traveller’s cheques, or similar instruments

-

Dealing in virtual currencies

-

Certain crowdfunding or fundraising platforms where the business controls the receipt, holding, or transmission of funds, rather than acting as a passive marketplace

Operating without registration can result in penalties, operational restrictions, or banking challenges.

AMLI Analysis: FINTRAC places particular scrutiny on ownership transparency, decision-making authority, and compliance leadership, especially for foreign-controlled entities or multi-layered ownership structures.

Common Reasons MSB Registration Applications Are Delayed or Rejected

Registration is only the first step. Once registered, MSBs are subject to ongoing supervision, including:

-

Desk reviews and on-site examinations to verify AML controls are implemented effectively

-

Assessment of Compliance Officer or CAMLO authority and risk-based decision-making

-

Evaluation of transaction monitoring, reporting, and recordkeeping

Many businesses mistakenly assume registration guarantees compliance. In practice, gaps often emerge during FINTRAC’s post-registration reviews, not at submission.

AMLI Analysis: Template-based programs may pass initial submission but trigger follow-ups once FINTRAC examines operational reality.

Where MSB Registrations Commonly Fail

Based on AMLI’s experience supporting MSB registrations, FINTRAC often identifies:

-

Nominal compliance leadership: CAMLO exists only on paper, with insufficient authority or visibility

-

Template-based AML programs: Generic policies fail to reflect actual transaction flows or risk-based decisions

-

Mismatch between policies and operations: Descriptions of hypothetical future-state controls create credibility gaps

-

Opaque ownership structures: Foreign ownership, layered holding companies, or unclear control arrangements raise red flags

AMLI recommendation: Addressing these operational realities before submission reduces follow-ups, delays, and corrective work.

Foreign MSB (FMSB) Registration: Operating Without a Physical Presence

Businesses outside Canada serving Canadian clients must register as a Foreign Money Services Business (FMSB). This allows access to nearly 40 million Canadian consumers without a local office.

Practical considerations for FMSBs:

-

Banks require clear documentation of cross-border ownership, governance, and agent network oversight

-

FINTRAC reviews governance structures, cross-border transactions, and compliance officer authority

-

Early registration supports operational planning and smoother banking onboarding

-

Ongoing obligations under the PCMLTFA still apply, including periodic risk assessments, reporting updates, and recordkeeping

AMLI Analysis: Foreign MSBs often experience longer review timelines due to added scrutiny on transparency, ownership, and cross-border AML controls.

For details on FINTRAC and banking expectations for foreign MSBs and physical presence challenges, see the blog: Fintrac Banking Expectations For MSBs

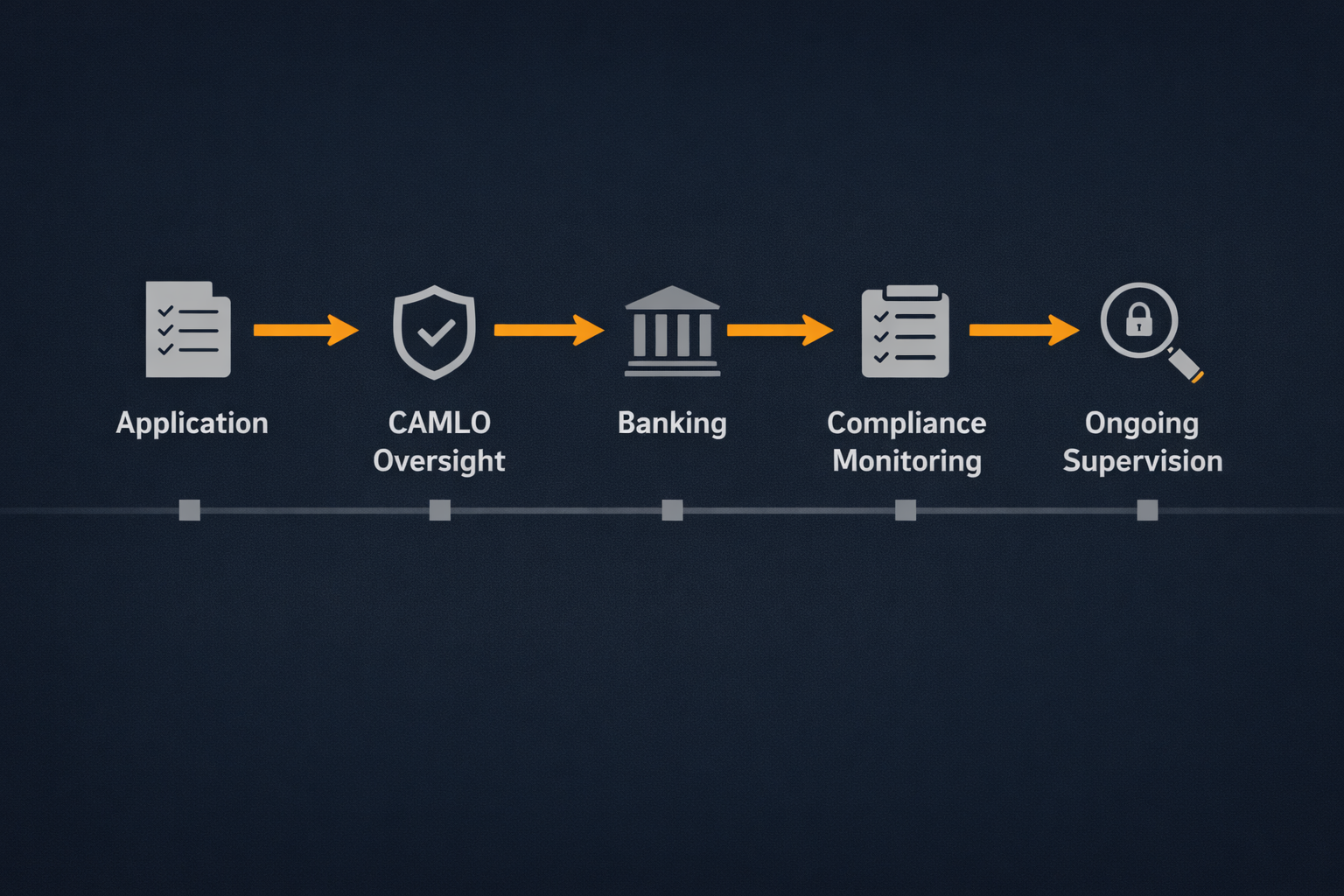

Steps for MSB Registration in Canada

-

Prepare a complete and accurate application

-

Include ownership structure, control arrangements, business activities, transaction flows, and compliance framework

-

Designate a qualified Compliance Officer or CAMLO

-

Authority, responsibilities, and decision-making power must be explicit and defensible

-

Submit to FINTRAC and manage follow-ups

-

Prompt and precise responses signal operational maturity

-

Plan for banking onboarding

-

Registration supports banking discussions, but financial institutions perform independent risk assessments

AMLI Analysis: Businesses that align policies with actual operational workflows face fewer delays and reduce post-registration follow-up requests.

Benefits of MSB Registration Beyond Compliance

-

Banking Access: Most banks require registration before onboarding; early registration signals regulatory credibility.

-

Partnerships and Market Access: Payment processors, fintech partners, and counterparties prefer registered businesses under regulatory supervision.

-

Managing Regulatory Risk: Proper registration and AML controls reduce the likelihood of penalties or enforcement actions.

-

Expansion and Licensing Readiness: Registration forms a foundation for provincial approvals, additional licensing, and growth.

AMLI practical analysis: Template-based programs often trigger follow-ups. Compliance programs must reflect actual operations, not hypothetical frameworks. For hands‑on help with MSB registration submissions and compliance program setup, see AML Incubator’s MSB Registration Services:

Frequently Asked Questions

Q: How long does MSB registration take in Canada?

A: 2–4 months for straightforward cases. Foreign ownership, template-based or fully AI generate AML programs, or complex operational structures can extend timelines due to FINTRAC follow-ups.

Q: Do foreign-owned businesses face more scrutiny?

A: Yes. FINTRAC closely examines ownership transparency, decision-making authority, and banking arrangements. Early registration reduces delays.

Q: Are generic AML templates sufficient?

A: No. Generic programs often trigger follow-up questions. AML controls must reflect actual business operations.

Q: Is registration enough to start banking operations?

A: Registration is necessary but not sufficient. Banks perform independent risk assessments. Alignment between registration disclosures and operational reality is critical.

Getting Support

While registration is manageable independently, having guidance can reduce friction. AML Incubator provides support to make the process smoother, including:

Businesses that calibrate their compliance programs with operational reality usually see faster approval and fewer follow-up questions.